Hi, all. This week brought an updated preview of Honeywell’s upcoming quantum system release. Personally, I’m still getting over that feeling “Wait….Honeywell???”, but this seems to be real. It’s a good time to update an industry perspective. What’s important here with Honeywell’s announcement:

- The underlying technology is Trapped Ions. This is a departure from the Superconducting approach that IBM & Google have been pursuing. Note: Honeywell is not alone. IonQ is another notable in the Trapped Ion space.

- Microsoft Azure is going to be an available “cloud” front-end to Honeywell quantum services. This is a move seemingly out of the recent Amazon playbook (part of the usual flurry of re:Invent launches), where recently Amazon announced the Braket service. Braket will front-end quantum systems from D-Wave, IonQ, and Rigetti. (Btw, at this point we should all know Bra-“Ket” is a play on quantum Ket notation, such as state |0> or |1> ).

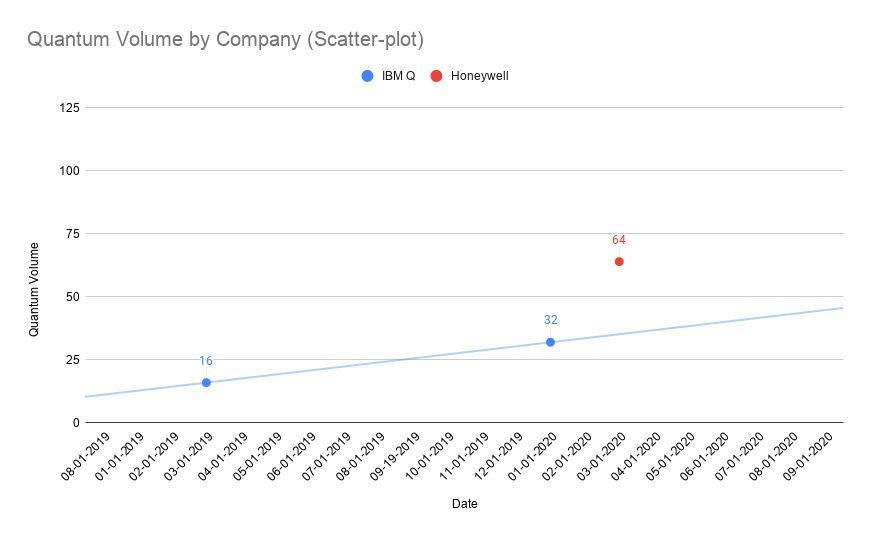

- Honeywell expects to make an exponential, leap-frog step to quantum volume 64, from IBM’s latest release at 32. Aside from the raw performance statement, this is a nudge towards quantum volume as a measurement standard vs qubit count.

From an industry perspective, IBM has continued to feel like the industry leader, at least in terms of apparent commercial system availability, marketing, and awareness. IBM Qiskit/QASM SDK tooling has become a standard point of comparison, although first half of 2019 Microsoft made moves to open source their quantum SDK, Q# (of course, before there was C#). We have yet to see a pure Microsoft quantum system, so this Azure news paired with Honeywell is hinting at their strategy. Like Amazon, it appears they could be taking a front-end approach, vs the high-capital system development path where Google, IBM, Honey, and smaller players such as IonQ, D-Wave, and Rigetti are battling for IP.

Recapping tech incumbent position:

- Google: High R&D investment in superconducting systems. (Due for a splash!)

- IBM: High R&D investment in superconducting systems AND large developer push with Qiskit SDK and QASM programming language

- Microsoft: Large developer push with Q#, apparent Azure strategy (Updated 3/9) with Honeywell, IonQ, and QCI.

- Amazon: (Expected) Cloud-first strategy with D-Wave (invested in by Bezos ventures), IonQ (headed by a former AWS exec), and Rigetti (just took another investment round of $71M).

Before wrapping this up, given my previous blog with a qubit count view, I also need to create a performance view using quantum volume. The Honeywell reads have been leverage quantum volume metric notation, but it should be noted that IBM originated the quantum volume concept in 2019.

Updated Q-bit Count View

Quantum Volume view per IBM Blog FYI:

And, here’s a fresh chart for quantum volume based on the latest article. Yah, it’s a little sparse. More to come on a cross-company view as this evolves….

Finally, I’d like to point out the headline in the Rigetti investment article:

I’m glad others agree. 🙂 However, it’s exciting to see the rapid advancement, and investment, in the space.